Welcome to our explainer series, taking important topics and going deeper!

What is the Inflation Reduction Act (IRA)?

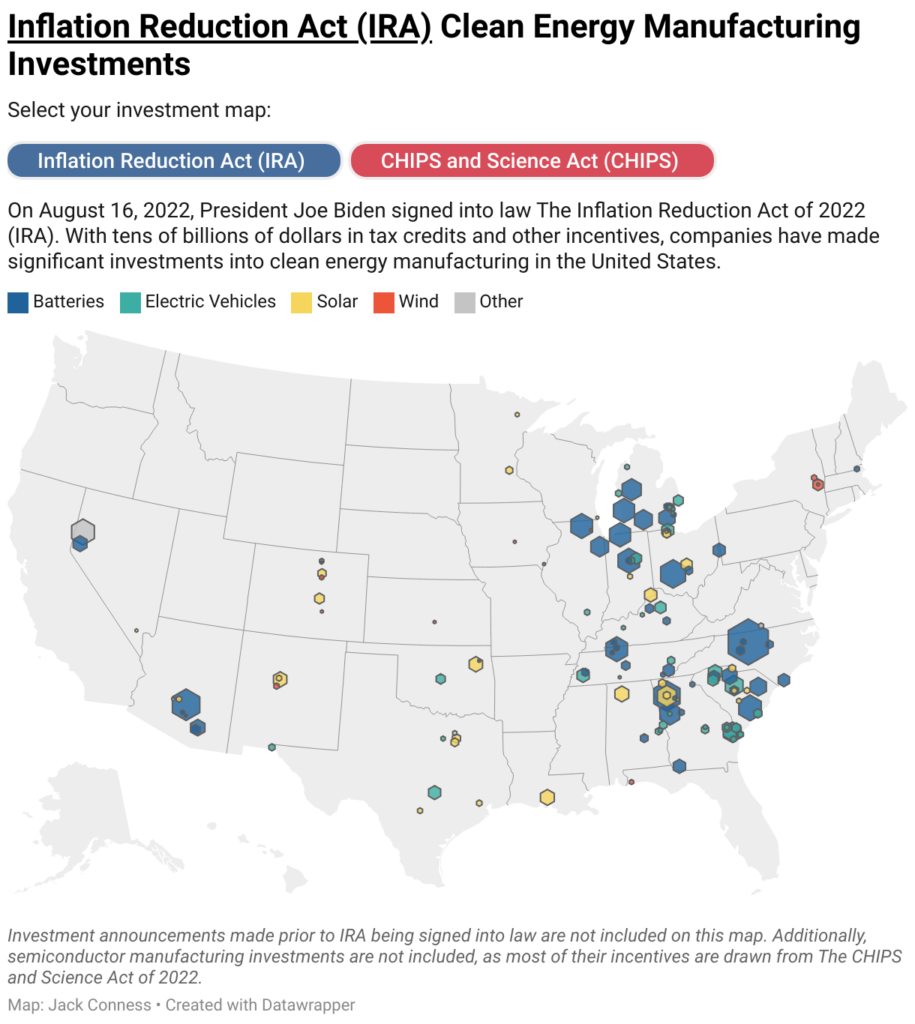

Last summer, the IRA made a big splash in the headlines for being an unprecedented climate action plan from the US government. Indeed, almost $370 billion was allotted to funding climate action.1 The main aim of the environmental policies in the IRA is to move away from reliance on fossil fuels. This means tax credits and rebates for renewable technologies like solar panels, electric vehicles, wind turbines, and heat pumps. But now that it’s been over a year, where are we? Has there been progress?

Has there been progress?

There has been an extraordinary boom in clean energy, as well as investment into clean energy manufacturing through cleantech loans from the Department of Energy (DOE). However, the maximum impact had by the IRA depends on a few factors. For example, how fast the government can distribute the funds, how quickly companies are able to adapt in order to take advantage of those funds, and of course, how willing and able consumers are to make all the necessary changes to electrify their lives. Additionally, the implementation of these laws will undoubtedly face opposition from politicians and communities. There is, of course, also the risk that the next administration might repeal some of the IRA.

Is it working?

One of the important things to get across is that the Inflation Reduction Act, and in particular the climate funding, is more of a promise than a guarantee, and requires active participation from citizens to take full advantage. The tax credits and rebates are there, we just need to use them! A big issue with the IRA is the lack of public awareness and information. It’s filled with incentives, rather than mandates, that are voluntary.3 As the funding is allotted for the next decade, many of the rules and regulations are still being figured out and finalized by the Biden administration.

What can you do?

There are still many things you can do to start electrifying your life. Yale Climate Connections does a nice job of mapping out what you should do in what order.4 First, get a home energy audit or a quick home energy check up (QHEC)! We’ve talked about this before, and we have personal experience! The audit will let you know how much energy your home uses, and also how to reduce superfluous use. Up to 30% of the cost, capped at $150, can be covered by the energy-efficient home improvement tax credit.5 This is the unequivocal first stop in understanding your home energy use, how to reduce it, and what renewable improvements you can make in your home. The energy-efficient home improvement tax credit can go towards many other, well, energy-efficient home improvements. New electric panels or rewiring may be needed to support improvements like heat pumps or other electric appliances. Ensuring your home is well-insulated can cut costs by keeping your house warm in the winter and cool in the summer, without too much help from heating systems. Over the next several years, think about replacing windows and doors. Especially in older homes, doors and windows can be big culprits for energy leaks. Because windows can be on the pricier end, replacing them can be a project stretched out over a couple of years.

In the longer term, or when it breaks, think of what can be replaced with renewable energy sources. If your furnace or water heater breaks down, replace them with heat pumps, which run on electricity and are far more efficient than traditional furnaces and water heaters. These are pricer appliances, and the tax credit caps at $2,000, so if possible, try not to purchase them in the same year, so you can make the most of the credits.

And, of course, electric vehicles are eligible for plenty of rebates and incentives. There are clean vehicle credits for both new and used electric cars. Remember, even though EVs are more environmentally friendly than traditional combustion engine cars, if your current CE car is still functional, it’s more sustainable to keep using it until you actually need a new car!

You can use Rewiring America’s IRA calculator to figure out how much money you can get with the Inflation Reduction Act.

What’s next?

The IRA is set to fund projects for the next decade, until 2032. As it moves through implementation, the laws, credits, and rebates will likely be slightly modified and become more concrete. You can sign up for updates from the White House to be the first to know.

Disclaimer: Sustainable Princeton does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Stay tuned for more!

We will be sharing our explainers at the end of every month. If there are topics you’d like to know more about, please email info@sustainableprinceton.org.

- https://www.democrats.senate.gov/imo/media/doc/inflation_reduction_act_one_page_summary.pdf ↩︎

- https://www.jackconness.com/ira-chips-investments ↩︎

- https://www.vox.com/climate/2023/8/16/23815837/inflation-reduction-act-joe-biden-impact-manufacturing-consumers ↩︎

- https://yaleclimateconnections.org/2023/01/checklist-how-to-take-advantage-of-brand-new-clean-energy-tax-credits/ ↩︎

- https://assets.ctfassets.net/v4qx5q5o44nj/3FYfJiYMILiXGFghFEUx0D/39c998988d5bea13ae015bddeeba1d59/25C_25D_Fact_Sheet.pdf ↩︎